Dialogue

Sources & Disclaimers

This dialogue paraphrases the sources depicted in the avatars. See the notes for references and links to source images not in the public domain. Avatars are used for the attribution of ideas (and, in some notes, direct quotes) and do not represent an endorsement of the dialogue’s text. Learn more about dialogues.

- John Thune, US Senator (R‐SD)

- Katharine Abraham, Economist

- Michael Strain, Economist

Student loan forgiveness is plainly unfair. Think about the families who saved and sacrificed to avoid borrowing. Think about the students who worked their way through college or gave up going to better, costlier schools. Or the brave men and women who served their way to a higher education in the armed forces.

- Richard Burr, US Senator (R-NC)

- Lindsey Burke, Education Researcher

And don’t forget all the conscientious borrowers who’ve paid their debt in full.

- Libby Nelson, Journalist

- Laura Perna, Education Professor

- Chris Hayes, Journalist

Before federal student loans, many college-goers paid their own way, chose cheaper schools, or relied on veterans’ benefits. By your logic, giving out loans in the first place was unfair. What’s unfair is the cost of college and the burden it’s put on the poor and middle-class, who carry about $1.2 trillion in student debt.

- Steven Beschloss, Journalist

- Aaron Fullerton, Writer

- Alexandra Petri, Columnist

Yeah, think of those people! Now imagine you go to prison under an unjust law. Should you have to serve out your time simply because others screwed by that same law served out theirs?

- The Editor

First off, college is expensive, but student debt is not a punishment. A college degree is an investment, and it tends to pay off. Second, student loan forgiveness isn’t unfair simply because others had to tough it out to repay or avoid student debt. It’s unfair because the students and families who toughed it out believed that loans must be paid back.

- Timothy Carney, Columnist

- Brittany Kasko, Journalist

- Rick McKee, Editorial Cartoonist

They played by the rule Pay your debts. That fair and just rule is trampled if borrowers, regardless of need or merit, are freed from the obligation to pay theirs.

- Jack Schneider, Education Professor

- Jennifer Berkshire, Journalist

- The Editor

Recent generations of borrowers believed that college pays you back with interest. They played by the rule Learn, earn, own. That rule is being broken. Although college grads still tend to make more than high school grads, a lot of them don’t have much more. College costs and consumer prices have doubled since 1990. Home prices have jumped more than 60%. And yet the median family income for college degree holders has barely budged.

- The Editor

Instead, their median wealth has shrunk. Look at people born in the 1980s–older millennials–with bachelor’s degrees. Unless they’re white, they tend to be no wealthier than nongrads. Meanwhile, baby boomers with bachelor’s degrees have double or more the household net worth of boomers without.

- The Editor

College grads are still better off, even if they’d prefer to widen the wealth gap. Higher earnings bring a higher quality of life.

- The Editor

College grads are more likely to be employed. They’re more likely to have health insurance. They’re less likely to use the social safety net. And they’re less likely to go bankrupt despite their debts, which, incidentally, aren’t just from student loans. Older millennials with college degrees are more likely to carry various consumer debt–credit cards, home loans, auto loans. Should those debts be forgiven, too?

- The Editor

Auto loans have been piling up about as quickly as student loans. In fact, in 2022 total auto debt, at over $1.5 trillion, basically caught up to total student debt. So, by your logic …

- Joe Biden, US President

- John King, US Education Secretary

Forgiveness isn’t justified solely by the size of the debt. Higher education is a wellspring of civic and economic vitality. Federal student loans were supposed to make it more accessible, but for decades college has gotten less and less affordable.

- The Editor

People just trying to better their lives through education have suffered. Leading up to the pandemic, a third of bankruptcies were fueled by student debt, which generally can’t be discharged. When the pandemic hit, about 1 in 5 federal borrowers were in default.

- US Department of Education

- The Editor

And the federal government, creditor for over 90% of student loans, took action: pausing payments and interest, erasing the debts of borrowers exploited by private for-profit schools, redressing failures of public service loan forgiveness, reforming income-driven repayment, and going after student loan servicers who for years misled and mistreated borrowers, deepening their debt. The government should act again, boldly, broadly, and by the same legal authority, to relieve a burden it directly controls and restore hope to tens of millions who sought its help.

Notes

Here are some typical criticisms of President Biden’s plan to forgive up to $20k in student loan debt for an estimated 27 million borrowers:

It’s a slap in the face and blatantly unfair to expect Americans who…paid off their loans, or paid their way through college to shoulder the cost of other Americans’ loans that they agreed to pay back. What about all the parents who scrimped and saved to send their children to college, or the students who chose a lower-cost college or worked to put themselves through? Not to mention the men and women in the military who fought for this country and earned money for their college education.

Sen. John Thune. A Slap in the FaceStudent loan forgiveness…would be a slap in the face to individuals from modest backgrounds who attended college but never took on debt or have already paid it off. What would the administration say to a person…who chose to attend their local community college rather than a more expensive four-year college because they did not want to borrow? Or to the people who avoided debt by serving in the military to qualify for GI Bill benefits?

Katharine Abraham, EconomistMichael Strain, Economist Biden’s About to Make a Big Mistake on Student LoansSometimes better schools are private and more expensive. Public schools, which can be top-tier, tend to be less expensive, with many graduates having no or below average debt. 42% of those who graduate from public 4-year colleges graduate with $0 in debt. 78% graduate with less than $30k. By contrast, the average student borrows more than $30,000 to pursue a bachelor’s degree. Sources:

Education benefits were the second-most cited reason to join the military among both pre- and post-9/11 veterans, according to a 2011 Pew Research Report: War and Sacrifice in the Post-9/11 Era – Chapter 3: Fighting a Decade-Long War – Why They Joined.

President Biden’s announcement that he intends to cancel student loan debt is irresponsible, unfair, and deeply cynical … Every American who paid back their student loans…should be outraged right now.

Quoted in Biden’s student loan forgiveness plan criticized by Republicans and a few DemocratsThe millions of Americans who graduated from college, lived modestly, and did without fancy dinners and vacations so they could diligently repay the debt they agreed to pay back are surely wondering why they will get no such rebate.

Lindsey Burke, Education Researcher Why Biden’s Student Loan Bailout Is Unfair22% of American adults say they’ve paid off their student debt, according to the Education Data Initiative: Student Loan Debt Statistics.

This reductio ad absurdum (

reduction to absurdity

) of the fairness argument extends the analysis given here:One [version of the fairness argument] holds that forgiveness is unfair to those who borrowed but paid off their debts — an argument that could be raised against any social program on behalf of those who were born too early to benefit from it.

Libby Nelson, Journalist Thefairness

debate over student loan forgiveness, explainedWhat we see…is a vast divide in outcomes between families with assets and those without … That stark inequality sets the stage for years of struggle for many students who try to better their lives through higher education.

Laura Perna, Education Professor Quoted in New indicators report shows escalating disparities for poor students, students of colorMiddle class families everywhere…are taking extreme measures. They’re cashing out their investment accounts, they’re taking out loans they can’t afford. Their kids are taking out loans, all to get them to go to a four year school … Isn’t it nuts that we have created a system where the ticket to the middle class is a thing that middle class families have to stress about, and hustle around, and borrow for, and beg, and plead, and patch together?

Chris Hayes, Journalist Inside the fight to obtain college at any cost with Caitlin Zaloom: podcast and transcriptAs of 2023, total student debt is $1.75 trillion, 66% of which ($1.16 trillion) is carried by borrowers earning $121k or less. Middle-class income runs as high as $142k, based on a 2021 median income of about $71k and Pew’s definition of

middle-income

as beingtwo-thirds to double the national median income.

Sources:In this analogy, debt accrued paying the high cost of college is compared to imprisonment under an unjust law. It’s an original variation on these sorts of critiques of the fairness argument:

It’s telling how many people oppose student loan forgiveness because they suffered through repayment and are determined that others must suffer, too.

Steven Beschloss, Journalist @StevenBeschlossI beat cancer. If they suddenly find a cure for cancer now, I’m gonna be so mad! This tweet is about student loans.

Aaron Fullerton, Writer @Aaron FullertonDISGUSTING! AWFUL! I have just received word that life is getting marginally better for some people, and I am white-hot with fury!

Alexandra Petri, Columnist Stop improving things right now! Everyone must suffer as I did! [Humor]For a rebuttal to these sorts of arguments, see: Here are the three worst arguments for forgiving student debt.

As of 2019, the return on paying for college is about 14%, according to an analysis by the Federal Reserve Bank of New York: Despite Rising Costs, College Is Still a Good Investment. For comparison, the analysis notes that the long-term return on stocks is 7%, and on bonds it’s 3%.

[T]he analogy … [between] cancer [and] paying off a student loan … reduces loan payments to suffering … [This] reduction totally ignores the idea of paying back what you owe. [emphasis in original]

Timothy Carney, Columnist Here are the three worst arguments for forgiving student debt[M]any hardworking, play-by-the-rules Americans have diligently paid off their student loans as a matter of personal responsibility. Many are still in the process of doing so. They believe in taking care of their obligations; for them, it’s the right thing to do.

Brittany Kasko, Journalist Florida-based mom pays off $40K in student debt after living ‘paycheck to paycheck’The Student Debt

Rick McKee, Editorial Cartoonist Rick McKee editorial cartoon: Student debtCrisis

Solved: 1. You took out a loan. 2. Pay it back.The Biden administration claims student loan

relief

will go toborrowers who need it most,

providingtargeted debt relief to address the financial harms of the pandemic.

Critics reject this claim, but they don’t appear to take issue with Public Service Loan Forgiveness or forgiveness that follows income-driven repayment.You may have noticed that

Learn, earn, own

is a descriptive rule, whereasPay your debts

is a prescriptive rule. For parity,promise

admittedly works better thanrule.

To wit: taking one view, the college wealth premium is a promise made to students that’s broken by the recent economy; taking another view, debt repayment is a promise made by students that’s broken by blanket loan forgiveness. Here’s a summary of the broken economic promise idea:For decades, young Americans have been told that college is the only way to get ahead. Their degrees, they were assured, would pay for themselves … College was a down payment on economic prosperity … As it turned out, college often didn’t pay for itself … [M]illions of the Americans who followed the rules and did what they were told ended up saddled with loans that, even in bankruptcy, were extremely difficult to discharge.

Jack Schneider, Education ProfessorJennifer Berkshire, JournalistJack Schneider, Jennifer Berkshire. The Broken Promise ofCollege for Everyone

From 1990 to 2020 the total cost of college rose from $12,894 to $25,910, according to Best Colleges. For a chart showing tuition, room and board, and total college costs at all institutions from 1963-2021, see: Cost of College Over Time: Rising Tuition Statistics – Total Cost of College Over Time.

From 1990 to 2020 the Consumer Price Index (CPI), which tracks the average cost of household goods and services, rose from 130.7 to 258.8, according to the Federal Reserve Bank of Minneapolis: Consumer Price Index, 1913-.

US housing prices doubled between 1990 and 2022, based on seasonally-adjusted data from the Organisation for Economic Co-operation and Development (OECD).

However, inflation-adjusted (but not seasonally-adjusted) data shows the cost of a house has increased only 63% from 1990 to 2022. See this tool: Historical US Home Prices: Monthly Median from 1953-2022.

The median family income for a bachelor’s degree holder in 1990 was just under $80k (in 2016 dollars). About a quarter-century later, it was just over $80k. See this report from the St. Louis Federal Reserve Bank: Is College Still Worth It? The New Calculus of Falling Returns – Fig. 3 Median Family Income. For similar data up to 2020, see this table from the National Center for Education Statistics.

Also, consider that in 1990 student debt was about 29% of starting salary, whereas in 2015 it was 74%. See: Preliminary Research on the Factors that Lead to Bankruptcy.

From a 2019 report published by the St. Louis Federal Reserve Bank:

Whites are the only racial or ethnic group born in the 1980s for whom a bachelor’s

William Emmons, EconomistWilliam Emmons, et al. Is College Still Worth It? The New Calculus of Falling Returns

degree provides a family with a reliable wealth advantage over comparable nongraduate families—albeit one that is much smaller than those enjoyed by earlier cohorts of college graduates. Even more surprisingly, the expected wealth premium among postgraduate families with a head born in the 1980s is indistinguishable from zero at standard confidence levels for all races and ethnicities.Baby boomers were born in the years 1946 to 1964. Among those born in the 1950s, earning a bachelor’s degree has boosted their net worth between 126% and 316% on average. Blacks gained the least, while other non-Whites gained the most. These data adjust for

the fact that the older cohorts have had more time to accumulate wealth than the younger cohorts.

Source: Is College Still Worth It? The New Calculus of Falling Returns.From 2010 to 2021, the employment rate for 25-34 year olds with a bachelor’s degrees or higher hovered around 85%, while those with only a high school diploma had a rate closer to 70%, according to the National Center for Education Statistics: Employment rates of young adults.

Looking at the unemployment rate from 2000 to 2021, college grads were about half as likely to be out of work compared to high school grads with no college, based on data from the Federal Reserve.

During 2020 and 2021, about 95% of bachelor’s degree holders were insured, compared to about 84% of those with only a high school degree, based on US census data.

From the US Census Bureau: Those With a High School Diploma or Less Make Up Majority of Government Assistance Recipients.

In 2010, roughly 1.5 million people filed bankruptcy. About 14% had a bachelor’s degree, while about 36% had just a high school diploma or GED. Based on US census data for 2010, which shows 41.3 million people with a bachelor’s and 71.2 million with an HS/GED, the less educated group was about 50% more likely to file bankruptcy. (The chances of filing were less than 1% either way.) Sources:

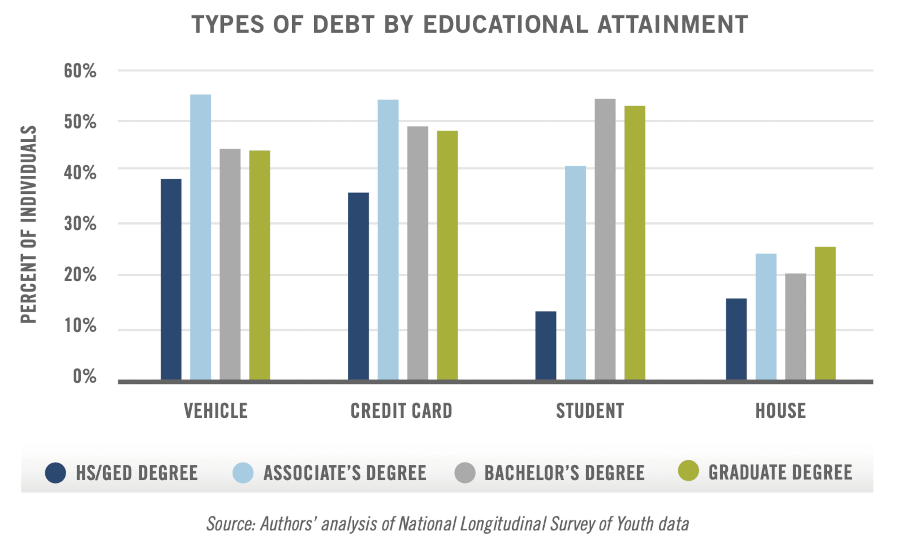

Based on a long-term study by the US Bureau of Labor Statistics that tracked about 9,000 people born in the early 1980s, the chart below shows debt by education level at age 25.

Total auto loan debt doubled between 2010 and 2022, based on data from the St. Louis Federal Reserve Bank. Total student loan debt also doubled in the same period, as shown here: Total Student Loan Debt.

In 2022, total student debt was $1.57 trillion, and total auto debt was $1.52 trillion, according to the Federal Reserve Bank of New York: Total Household Debt Reaches $16.51 trillion in Q3 2022; Mortgage and Auto Loan Originations Decline.

Although auto loan debt has kept pace with student loan debt since 2010, student loan debt started its steep climb years earlier. Inflation-adjusted data on federal student loans shows a more than 6 fold increase from 1995 to 2017: The Volume and Repayment of Federal Student Loans: 1995 to 2017. Even when looking at unadjusted Federal Reserve data, auto loans increased only 3 fold during that period.

Rapidly rising student debt is usually tied to ballooning college costs. Since 1978, tuition and fees have increased nearly 14 fold, while overall consumer prices have increased only 4 fold. (Source: Is College Still Worth It? The New Calculus of Falling Returns.)

It really comes down to this idea that debt-free college is a public good, and just as we think about K-12 education as serving the public interest, the health of our economy and the health of our democracy, so, too, should we think about higher education.

Secretary John King. Quoted in Why there’s a unified movement to cancel student loans but not credit card debt or mortgagesThe idea seems to be that higher education serves the public or common good, both socially and economically, and thus so does the federal student loan program. But that’s not quite the same as saying higher education is a public good, as economists define it, nor then that federal student loans are.

As noted elsewhere, college costs have outpaced other consumer prices while incomes have stagnated. Here’s a bit of what President Biden has said:

Since 1980, the total cost of both four-year public and four-year private college has nearly tripled, even after accounting for inflation … That has left many students from low- and middle-income families with no choice but to borrow if they want to get a degree.

President Joe Biden. FACT SHEET: President Biden Announces Student Loan Relief for Borrowers Who Need It MostHere are two analyses of the rising price of college (with the second being more conservative):

See this 2019 story from Business Insider: An astounding number of bankruptcies are being driven by student loan debt.

See this 2020 fact sheet from Pew: Student Loan Default Has Serious Financial Consequences.

Starting in March 2020, payments and interest on federal student loans were paused: Timeline: Federal Student Loans During the COVID-19 Pandemic.

As of February 2023, loan forgiveness for students who attended for-profit schools totals over $1 billion dollars. (Source: For-Profit College Student Loan Forgiveness List.) Here’s some context from USA Today:

For-profit colleges have faced scrutiny for decades, including over their predatory practices and targeting of veterans, abuse of public funding and high percentages of students who leave unable to pay off their debt.

Alia Wong, Journalist It’s time for college leaders who fueled student loan crisis to pay up, Ed Department saysThe Public Service Loan Forgiveness (PSLF) Program is an important—but largely unmet—promise to provide debt relief to support the teachers, nurses, firefighters, and others serving their communities through hard work that is essential to our country’s success.

US Department of EducationUS Department of Education. Fact Sheet: Public Service Loan Forgiveness (PSLF) Program OverhaulChanges to income-driven repayment (IDR), which have not been finalized, would cut a borrower’s monthly payment by half or more in most cases. More info here: The New Income-Driven Repayment Plan: How It Works.

In 2022, the Consumer Financial Protection Bureau (CFPB) won a lawsuit against loan servicer Navient, who was accused of predatory lending practices: CFPB Wins in Suit Against Student Loan Servicer. Also see: Analysis: Dishonesty in Loan Servicing.

The same law that authorized the US Department of Education to pause federal student loan payments and interest due to the pandemic—the HEROES Act of 2003—also authorizes it to cancel loans due to the pandemic, according to the Biden Administration. The Supreme Court is set to rule on whether that’s the case. Their decision is expected by the end of June 2023. Sources:

- HEROES Act at Center of Debt-Relief Legal Fight

- Supreme Court student loan hearing: What you need to know

UPDATE: The Supreme Court rejected the Biden administration’s legal rationale. See Supreme Court strikes down Biden student-loan forgiveness program.